Body and Mind Studio International Ltd (BMSIL) is a company incorporated in and trading from premises in the United Kingdom (UK). All of our stock is held in the UK is shipped from the UK.

Following the UK’s decision to leave the European Union (EU), important changes to the EU’s value-added tax (VAT) rules came into effect on July 1, 2021. This impacted businesses that sell across EU country borders and businesses exporting goods to buyers in the EU, known as Business-to-Customers (B2C).

To comply with all relevant legislation and assist with the smooth implementation of what was in effect a “Hard Brexit”, BMSIL took immediate action to ensure we could continue to provide our much-valued customers both in the UK and across the EU with the products they love so much from our range. However, there are some products we are unable to ship to the EU which can be found >> here <<

Import One-Stop-Shop (IOSS)

The new rules from July 1, 2021 stated that if we sell B2C consignments with an intrinsic value of less than €150 (which we regularly do), then this comes under what is known as the Import One-Stop-Shop (IOSS) regime and we had to register for an EU VAT number. To check the intrinsic value of your order (products only excluding shipping charge), click on the link below to give you the most up to date GBP to EURO exchange rate:

Or;

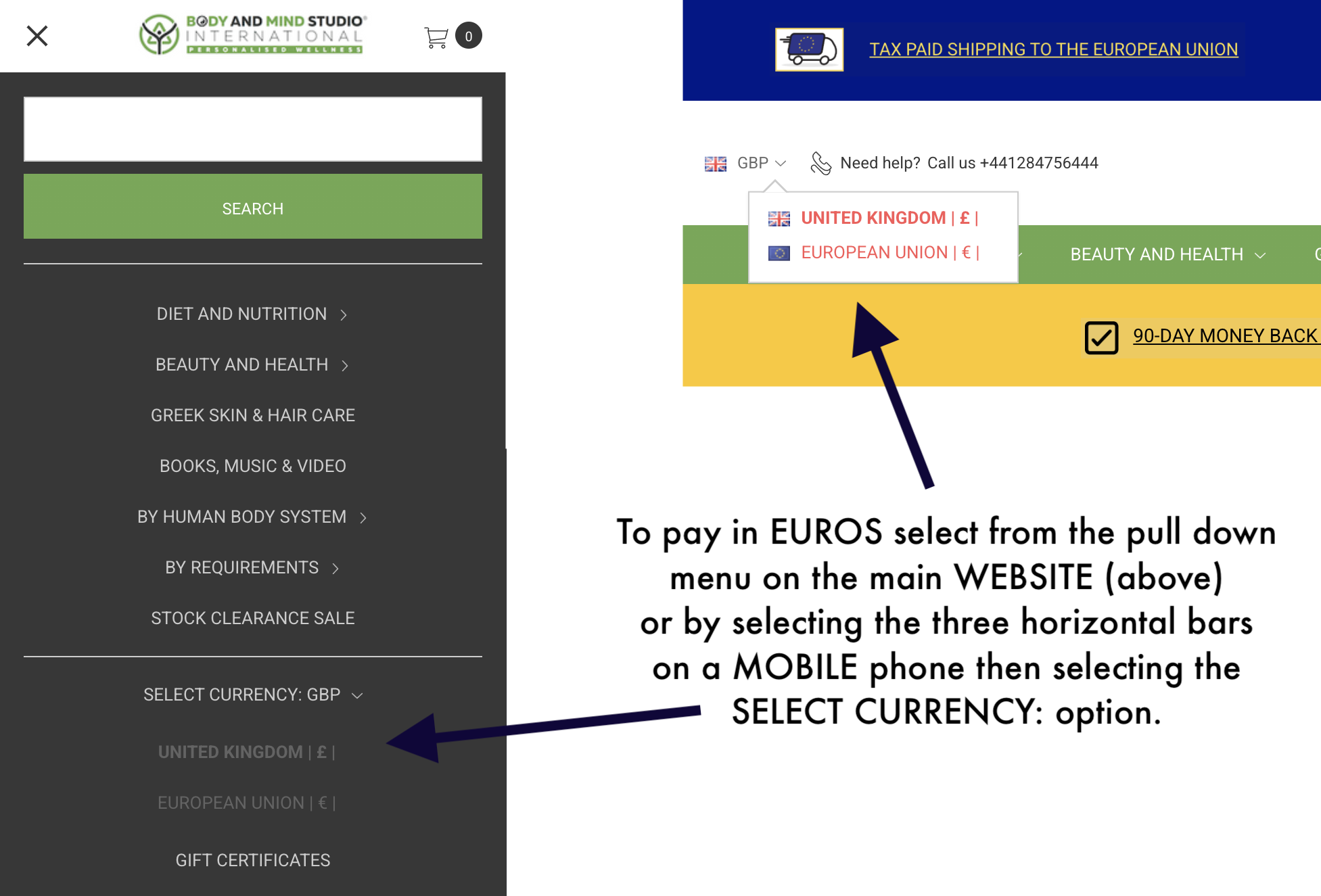

We give you the option to pay in Euros (€) by changing the prices you see into Euros. You can do this by selecting the options below depending on whether you are using a PC or a mobile phone:

What does Intrinsic Value Mean?

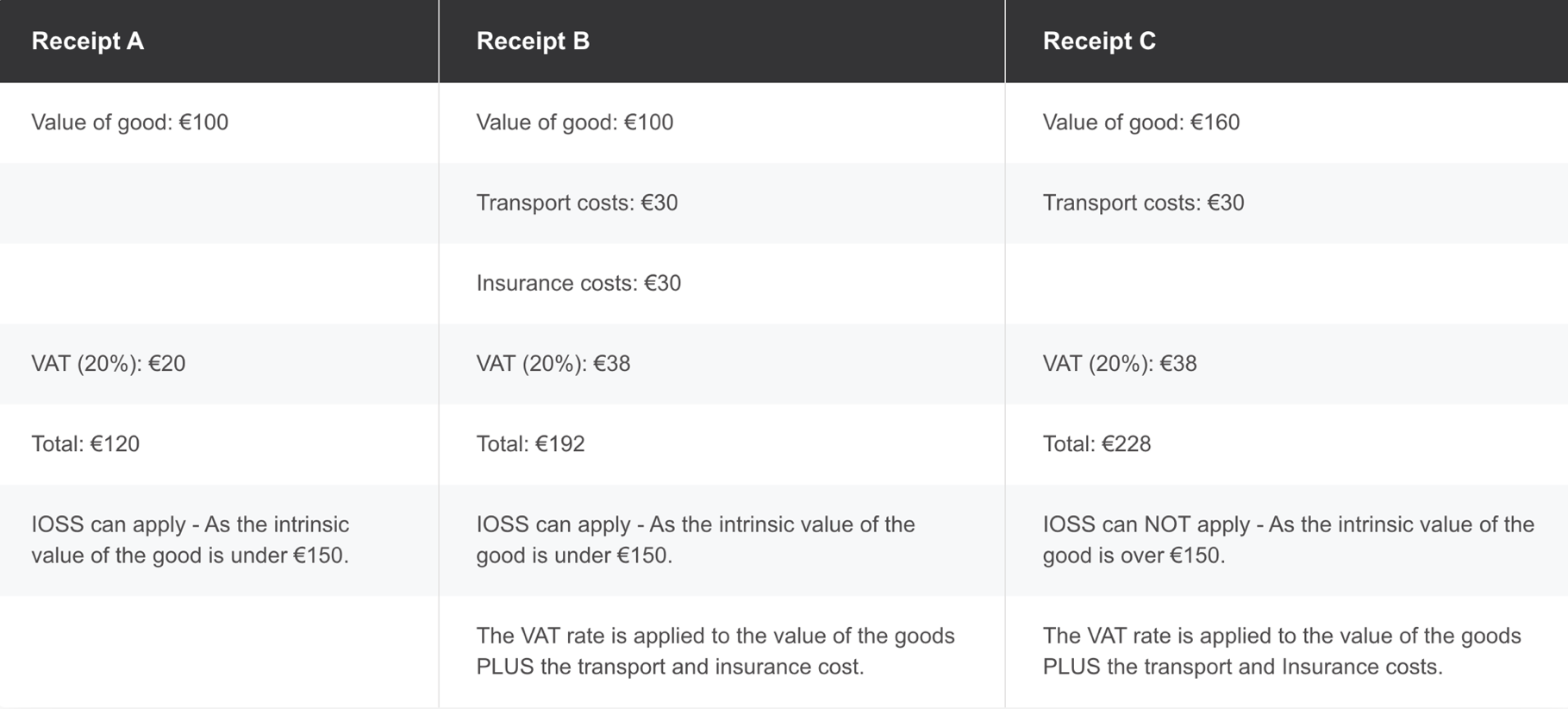

For the purposes of the IOSS, "intrinsic value" means:

"For commercial goods: the price of the goods themselves when sold for export to the customs territory of the EU, excluding transport and insurance costs, unless they are included in the price and not separately indicated on the invoice, and any other taxes and charges as ascertainable by the customs authorities from any relevant document(s)."

Examples of when IOSS does and does not apply can be found here:

It is important to note that the above only applies to Business-to-Customers (B2C) transactions. It does not apply to Business-to-Business (B2B) transactions.

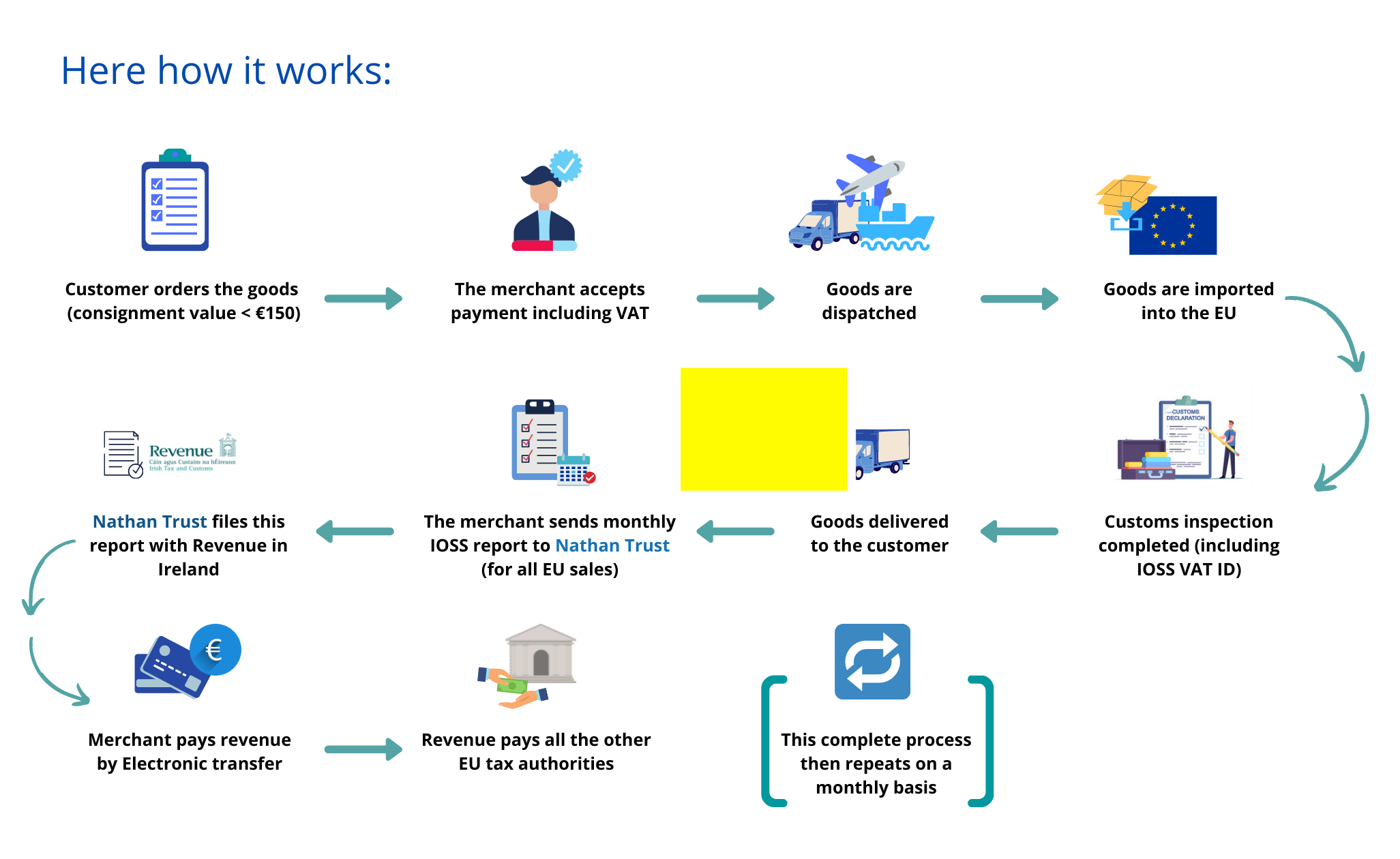

BMSIL established our IOSS in the Republic of Ireland by appointing Dublin and Cork based accountancy firm Nathan Trust as our IOSS Intermediary. Our IOSS intermediary completes our monthly IOSS filings, i.e. pays our VAT to any and all of the 27 EU member states we trade in every month, as well as acting as our tax agent in the Republic of Ireland.

So, what does that mean for you – the customer purchasing from BMSIL for shipping to any county in the EU?

Well, simply it means that if you wish us to ship a parcel to the EU, when you place an order under €150 (excluding carriage charges - which incidentally are VAT exempt) i.e. the total value of products purchased is under €150, we the merchant just ship out your order, pay the relevant VAT to the country we are sending to, and it’s as simple as that!

Here’s an example of how it works:

- Brian in The Netherlands orders a D’Adamo Personalized Nutrition Catechol at £27.95 from us at BMSIL here in the UK.

- BMSIL charges Brian £27.95, which is approximately €32, inclusive of 21% VAT which is the rate in The Netherlands.

- BMSIL ships the product to Brian, and it is delivered a few days later without any delays due to the fact that there is no VAT or customs duty on this transaction as the consignment value is less than €150.

- As BMSIL are registered for IOSS in the EU, we file our IOSS report, and pay the VAT owed to ALL EU member states we have traded in that month to the Irish tax authorities (Revenue).

- Revenue then pays the VAT over to all the relevant tax authorities, in this case it includes The Netherlands.

If your parcel has been shipped by BMSIL via Royal Mail (you will know this from the shipping e-mail we send you at the shipping stage), the label on your parcel will show the words IOSS in white text within a black circle on it. This guarantees to the customs office that the relevant country specific taxes have been paid by BMSIL and NO additional charges should be charged by them to the parcel recipient. This is what to look for:

What happens if my parcel is over €150?

As BMSIL goods are stored outside of the EU, i.e. in the UK, then the purchaser of the goods becomes the importer of record, meaning that they are liable to pay import VAT on delivery of goods.

So the procedure would be as follows:

- BMSIL ships the goods to the border of the country where the purchaser has requested shipment to.

- The customer then receives a notification to pay VAT and import duties to obtain their products.

- Once the amount is paid, the goods are cleared by the local customs office and sent to the customer.

Useful information we have found so far which may assist you when purchasing from Body and Mind Studio International Ltd for import to an EU Country - We strongly suggest you do your own research before ordering.

If you are purchasing from BMSIL for shipment to an EU country, before purchasing we strongly suggest that you Read and understand our Terms of Business (especially but not limited to Item 10.) as it is your responsibility to know whether you are able to import the products you purchase into your country and what additional import/VAT costs may be applicable to your particular order.

Food supplements in the EU are governed by the European Directive 2002/46/EC which is then transcribed in each Member State. Notification requirements, authorised nutrient levels and the composition of supplements remain specific to each country.

PORTUGAL (República Portuguesa) ** CAN WE SHIP TO PORTUGAL? YES/Podemos enviar? SIM **

We are able to ship to Portugal but additional information is required when an order is placed. We need an individuals' NIF (Numero de Identificacao Fiscal), also known as a Contribution Number (Numero de Identificacao Fiscal) before we can ship to Portugal. This is a 9 digit number in the form: 999 999 999. Without this number a parcel will not be received by the purchaser if we were to ship. It is essential.

Source: https://www.crownportugal.eu/nif-registration-personal-tax-number-in-portugal

Products we are unable to ship to the European Union

Unfortunately, there are certain products which we are unable to ship to the European Union due to EU legislation which prevents us from doing so. If you see the above image on the product, please do not order if you wish us to ship the products to the European Union. If you do, place an order with us which includes any of the products below, unfortunately we will have to refund you but charge you a 10% admin fee due to the admin costs to issue the refund. This forms part of our Terms of Business which can be found >> here <<.

EUROPEAN UNION COUNTRIES WE CANNOT SHIP TO:

GERMANY: Since January 01, 2023 we can no longer ship nutritional supplements to Germany due to German law preventing it. However, we can ship most other items so please contact us via our >> contact page << for further information.

DEUTSCHLAND: Seit dem 01. Januar 2023 können wir Nahrungsergänzungsmittel nicht mehr nach Deutschland versenden, da dies durch deutsche Gesetze verhindert wird. Wir können jedoch die meisten anderen Artikel versenden, also kontaktieren Sie uns bitte über unsere >> Kontaktseite << für weitere Informationen.

SPAIN: Since January 01, 2023 we can no longer ship products to Spain. To date we are still unsure why but they are always returned to us.

ESPAÑA: Desde el 1 de enero de 2023, ya no podemos enviar productos a España. Aún no sabemos el motivo, pero siempre nos los devuelven.